The endowment effect

"For most things are differently valued by those who have them and by those who wish to get them: what belongs to us, and what we give away, always seems very precious to us."

— Aristotle, The Nicomachean Ethics book IX (F. H. Peters translation)

"The best thing with having a Black Lotus, is that you have a Black Lotus"

— Martin Beer (paraphrased)

Back in my student days, I had a ritual of sorts at the start of every summer.

If you go for higher education in Sweden, you get a small stipend and a loan every month to cover your basic needs. During summer there are typically no classes however, and you'll have around three months each year without that “student income”. So the reasonable thing is to find some seasonal work to pay the summer bills. My seasonal employments as a student included grocery stores, home care facilities, janitorial work, postal services, retirement homes and stock houses. One summer I worked down the harbor, unloading containers by hand while getting payed by the foot. That one also saved some money on the gym membership.

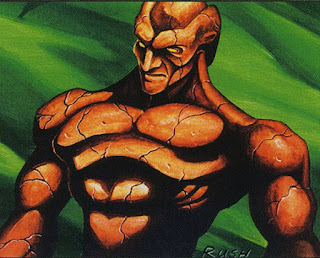

|

| Me, circa 2008 |

Anyway, the paychecks back in Sweden are most commonly delivered on the 25th the month after the work is done. So if I started working in June, just after class was dismissed, I'd get my first paycheck by the end of July. That meant I basically had no income for at least a month at the start of each summer. Some people handled this by part-time work parallel with the classes, via advance payments, or loans. Or parents, I guess. Me, I started each summer by watering down Magic decks.

|

| Start of summer, sell my playset. End of summer, buy it back. Repeat every summer for five years. |

Early each summer I would sell a pile of cards, usually just enough to help me pay the bills for the coming weeks. At the end of summer - when I had my last paycheck from work coming in at the same time as the new semester's first stipend - I'd buy most of the cards again. And perhaps some other things I'd been dreaming of in the past months. I vividly recall one summer with a kinda rough job where I used to motivate myself thinking that days spent toiling could translate to duals in September.

|

| Ah, motivation duals. |

In 2012 I finally started my first proper full-time job. As a part of the assignment, I had to move to a new country and acquire quite a bit of cash for apartment deposits and such. To make room for this I sold most of my duals, my Timetwister, my Library, and most other expensive cards I'd gathered up to that point. I kept cards for oldschool WW and Tax Edge, and the Legacy control deck was left mostly intact, but everything else was on the table.

|

| Hey, got almost $100 for this one. Can't complain. |

I haven't had to sell cards to cover necessities or life expenses since then. Maybe I'll have to push that particular panic button again sometime, but these days cards are not a part of my economy any more than beer is part of my economy. It's an enjoyable expense. I don't look at my cards as investments or savings; for that I have other (proper grown-up) thingies. I never buy cards with any intention to sell them; and when I do sell cards, it's - with very few exceptions - either to get money to buy another card (i.e. trading with extra steps) or for charity.

|

| Trading is pretty rad though. |

I guess I wanted to start with this backdrop as today, I'll actually write about #MtgFinance. Or something in the vicinity. It appears card prices are all the rage in the Magic community in general, and old school cards in particular. So I figured this could be as good a time as any to go deep nerd on a few peripheral topics from my current day job (coaching a team working with risk and credit models in a larger bank). In particular I though it might be interesting to look at why so many of us could find #MtgFinance people annoying, why our nostalgic cards are so hard to buy these days, and why missing out on gains hurt more than having our own cards grow make us happy.

(Sidenote: If you actually came for insights on contemporary #MtgFinance, first, welcome to the blag! We're mostly casuals here, and we don't do that much in terms of contemporary. And I believe that whole deal is mainly FOMO. Like 80% FOMO, 20% other things. And if fear of missing out is the main motivator, you should consider what you are afraid of missing out on. Is it money? Then there might be better options than Magic. Is it experience and good games? Then I must point out that I played oldschool for almost five years before I got my first power cards, and that the last tournament I played I went for powerless monogreen and smashed face with Craw Wurm. Still had a blast. When people brag about good games and experiences, it's rarely the Mox, Mox, Lotus plays. It's more often things like this:

It could be other things of course. I am a simple man and just want to rifle shuffle an Alpha Lotus in penny sleeves while drunk. And that's a hard sell unless its your own Lotus. So anyway, ask yourself why your are afraid of missing out - and what you are afraid of missing out on - before you let card prices ruin your mood. But going deep on FOMO is not the focus today. Today we'll rather look at a slice of the other 20%. And I will get to show some graphs. Sweet. End sidenote.)

|

| Here's a graph. |

Let me start with an example. I own two Mishra's Workshop. I got the first one about seven years ago and the second two years after that.

|

| Turn one Dragon Engine. Face. |

Having two Workshops is of course very nice, but - as these things go - it is a kinda strange number to have. The argument for having one mostly goes by itself; it is an awesome restricted card in most old school formats I partake in, and a solid piece in many contemporary highlander formats and cubes. The argument for having four is also solid; Shops is one of the best decks in Vintage, and in old school formats where Workshop is unrestricted having four at disposal unlocks quite a few different high tier strategies. But having two without looking to get the third and fourth looks kinda odd. For Mishra's Workshop, I find myself being neither a buyer nor a seller. And on that note, I own two Lion's Eye Diamond and one and a half playsets of Sylvan Library, without looking to sell my "extras" nor completing the playsets. Neither buyer nor seller. From a traditional economic standpoint, this would qualify as irrational.

|

| My current and future Sylvan Library playsets. |

The psychology behind this is kinda fascinating. I mean, they guys that formalized prospect theory got the Nobel Prize in economics in 2002 after all.

Prospect theory observes that we make decisions based on potential gains or losses relative to specific situations, rather than in absolute terms (known as "the framing effect"). We assess loss and gain asymmetrically, and react more strongly to losses than gains. Additionally, unless the outcomes are ignored altogether, we tend to over-weight probabilities for high and low chance outcomes (known as the certainty effect and the possibility effect). Contrary to expected utility theory of perfectly rational entities, prospect theory look at at how humans actually behave.

Say I offer you a coin flip. If you win you'll get $2,000 and if you lose you'll have to pay me $1,900. That bet is clearly in your favor, but most people would still decline it. Losing $1,900 is more painful that gaining 2,000 is joyous. What if you stood to gain $2,000 but could only lose $1,000? That is closer to where most people find the coin flip acceptable, but quite a few of us would still be skeptical (unless you got the option to take that same bet multiple times in a row of course). "Losses loom larger than gains".

|

| This may not apply entirely to Shaman "Let's-play-a-best-of-one-Belcher-mirror-for-our-entire-decks" Ben Perry. But hey, we're talking humans here, not folks of Leng. |

When we are exposed to risk, we tend to be risk-averse in the face of potential gains and risk-seeking in the face of losses. This risk aversion make us take actions that don't align with expected utility. Consider the following options:

1. Selling a card for $17 to a trusted store

2. Selling that card for $20 to a sketchy character, with a 10% risk of them refusing to pay after you've sent the card

Expected value of option 2 is clearly better, but a majority would give up that dollar to avoid risk. On that same note, if I'd offer you a choice between getting $900 for sure and a 92% chance of getting $1,000 (and 8% chance of getting nothing), most of us would opt for the sure thing. But when it comes to losses, these preferences are commonly reversed; if we had to pick between losing $900 for sure or having a 92% chance of losing $1000 (with an 8% chance of losing nothing), we are likely to take the gamble. Suddenly losing $900 is eerily similar to suddenly losing $1,000 as emotions go, so mise well take the gamble for a chance at avoiding bad beats altogether. Daniel Kahneman summaries his findings like this:

|

| Via his excellent book Thinking Fast and Slow. |

This whole human risk aversion in the face of potential losses have a tendency to make card trading a bit harder. When we're talking very old cards, we tend to see the risk for losses negligible, while recent history hint at a possibility for large gains. A card like Ashiok, Nightmare Weaver would never suddenly be worth thirty times its price tag a few years after release, but the Alpha Braingeyser and Jayemdae Tome I picked up around the release of Theros had a very different trajectory. There is of course no guarantee that old or rare cards will increase in value at all, and certainly not that the gains will be very large. But the possibility is there, and it makes us more likely to reject what would otherwise be favorable offers. And so the market moves, and it all becomes a self-fulfilling prophecy where people want $90 for their Repentant Blacksmiths.

Another interesting psychological aspect here - if we would look at cards like assets for a moment - is that we are more likely to sell something if we can get more than payed for it. We want to win our bets. Say you need to liquidate some assets to get money for your wedding, let's go with $2,000 for beer and midnight kebab (this wedding has free beer and kebab, as all real weddings do). In your grown-up portfolio you have stock positions in two companies, both positions being valued at $2,000 right now. However, you bought the stocks in company A for $4,000 and in company B for $400.

Selling the position in company A would force you to acknowledge that you made a bad investment, and the sting of losing 50% of the money you put in is very uncomfortable. Selling company B comes with a much better story; e.g. you being a mastermind that got a 400% return on investment (nevermind that it would actually be more profitable to sell the loser with regards to tax breaks a few months down the line). And also nevermind that A might be a worse stock to hold than B. The sunk cost fallacy is a thing, and we don't want to go out as suckers.

This might not impact a casual trader too much, but it certainly have a say for professional sellers. If you payed $20 for a card with the goal of some monetary profit, you'd have to be hard pressed to sell it for less. But if your approach is purely as a player, you might get other value/utility out of playing the card, and might be very satisfied selling it for $12 after a couple of years of good use. But these day, physical tournaments are few and far between. That means we don't get our expected utility, and even "pure players" are reluctant to abandon a card before it manages to create some sort of value; be it good games or cold money. We are loss averse, and when we also see a small probability for large gains, we are risk seeking.

I could have a graph here I suppose, but let's instead flash the general case formula for subjective utility of a risky outcome described by probability measure p:

|

| Math! Read all about it here. |

Now let's steer back towards those Mishra's Workshops. And the title of this post I suppose. The endowment effect.

I occasionally buy stocks. Not long ago, I bought a small number of stocks in Kahoot. If they would eventually double in price, I'd sell them in a heartbeat. A short while before I bought them, I also bought a Sliver Queen for a casual Highlander Gold deck (it's an actual format in Gothenburg). I payed $140 or so for it. Just after I bought it, I saw that another person was selling hers for $110. In my head, a nice Sliver Queen should be around $140, and I had some money to spare (yay, no travel expenses :/), so I bought that one as well. Don't really know why, as I'm unlikely to ever play two. I guess I thought it was a good deal or something.

Thing is, as I type this, Sliver Queen has a TCG Market price of over $220. So why the balls am I not selling my extra Sliver Queen? Sure, I might not need the money for necessities at the moment, but if I sold it I could justify trading that $220 towards other cards I want. Like, it's a big step in the direction of a Diamond Valley or a Gaea's Cradle. But it appears I have a very different attachment to cards than I do to stocks.

Maybe I think that Sliver Queen is a solid card to hold and that it will reach $400 in a couple of years? But if that was my actual agenda - looking at the card as a good investment - then rationality holds that I should also be a buyer at current retail. But I'm not.

In economics, the maximum amount I'm willing to pay for something is known as willingness to pay (WTP), and the minimum amount I'm willing to sell something for is willingness to accept (WTA). The price of any transaction will be a number between the seller's WTA and the buyer's WTP.

Here's the kicker though. In a valuation paradigm, people's maximum willingness to pay to get the hands on an object is typically lower than the least amount they are willing to accept to give up that same object after they acquired it - even when there is no cause for attachment, or even if the item was only obtained minutes ago. If you own something that you can picture yourself using, you are reluctant to trade it for something of similar value. This is the endowment effect. It can be defined as "an application of prospect theory positing that loss aversion associated with ownership explains observed exchange asymmetries".

We are not hesitant to trade a five dollar bill for five ones. Neither are we hesitant to shop for shoes, as the money was effectively a proxy for what we were going to buy in the first place. There's no loss aversion for either buyer or seller on routine commercial exchanges. But if the thing we're giving up have some intrinsic value for us, or maybe it comes with a story, things get irrational. E.g. in one study the participants' hypothetical selling price for NCAA final four tournament tickets were 14 times higher than their hypothetical buying price. And in one of the more famous studies on the endowment effect, participants in an experiment were randomly given coffee mugs (Sellers), while other people were invited to look at their mugs and make an offer (Buyers). A third category (Choosers) would get to decide if they wanted to receive either a mug or a sum of money, and indicate how much money would be as good as the mug. How much was the mug worth? Sellers though $7.12, Choosers $3.12 and Buyers $2.87. In particular the gap between Sellers and Choosers is remarkable, as they face the same choice! (Go home with either mug or money).

For a Sliver Queen, I'd be willing to be a buyer at $140, that's my WTP. And if someone offered me the choice between $200 and a Sliver Queen, I'd chose the money. But I'm probably not selling or trading one of my Sliver Queens for less $500. That is just stupid, especially as I just noted that I'd rather have $200 than an extra Sliver Queen, and I right now have an extra Sliver Queen. But that Sliver Queen is my Sliver Queen, and I'm attached to it and will over-value it, even when I perfectly well realize my folly. And that is the background of my half-playset Workshops. I'm not a buyer at current market price, but silly enough my WTA is still well beyond that.

It's easy to spot how hard this can make trading old school cards. I mean, all we do is trade in

nostalgia and endearment. Our cards have stories, and owning them can almost become a

part of us as players. I postulate that Juzam is worth a pile simply because those of us

who happen to own him overvalue him, and selling Juzams hurts more than it logically should. I wouldn't want to buy Juzams for over $500, but I still value the ones I own at ONE BILLION DOLLARS.

|

| THIS IS THE GREATEST CREATURE IN MAGIC AND MINE ARE WORTH ONE BILLION DOLLARS. SHUT UP ÅLAND. |

Years ago, a few moments after I got my Black Lotus, a friend asked if I was willing to sell it. I said no. He went on, "But what if someone offered you twice what you just gave for it, surely you would sell?". But now that the card was in my hands, I curiously valued it far more than that. He pressed me to come up with a sum, and I said I wouldn't sell the Lotus for less than around four times what the asking price had been less than an hour earlier. I just loved the card, and finding another to replace it would be hard. And even if I did, it wouldn't be this Lotus. My personal evaluation was of course nowhere near what anyone would be willing to pay at the time, and I knew that. But it seemed like giving it up now that I finally had it would be surprisingly painful, and my evaluation had to reflect that.

|

| There are a few like it, but this one is mine. |

I think this is why we can occasionally get annoyed by MtgFinance purists. We sometimes find them valuing things "the wrong way". That they might not look at the same utility we do, and in turn we might feel that financial goals make our goals unnecessarily hard to attain. When someone looks at buying and selling old school cards as a routine commercial exchange, one that you can "game", it can almost feel insulting for those who don't use the same value metrics. The value for us is often something more than a dollar number. Having Pyramids at $300 bothers the crap out of those of us who just want to build a tier8 Geddon/Dingus Egg deck. Like, how the tits is Pyramids more expensive than Serendib Djinn? That's just wrong, right? Pyramid's hasn't even been a combo with Strip Mine since 4th was released.

|

| This whole thing all seems like some sort of scheme... |

With that said, I still don't think it's worth stressing out too much over people who find other utility in the cards than we do. That may sound easy enough for me to say now, but I did enjoy Magic immensely in the first 18 years of playing before I had a Lotus too. Magic is simply a great game, and we are free to enjoy it in whichever way fits us best.

...

So that's my 4,000 words on the peripherals of MtgFinance. I might not go back here, as I feel it is a subject that can create more drama than enjoyment. But it was nice to find an excuse to put up a math formula on the blag again. And if you want my take on option pricing using Black-Scholes theory, feel free to raise your hand.

I don't know if this post felt in any way enlightening or just like beating a Tarpan. But I think it is nice to be casually aware of the endowment effect, loss aversion and prospect theory if we look at the economics of our hobby. Knowing the psychology can make it a little less rough on the emotions when we see some card spike out of reach, or when the last card we need for our tier8 deck is Pyramids. And if our hobby makes us feel stressed, we might not be approaching our leisure time the right way.

This whole thing was probably economics more that finance. But if I would give one advice as #MtgFinance goes, it would be this: Fear of missing out is basically peer pressure with extra steps. Dig deep on what you are afraid to miss out on, and you might just realize it is not a card. It might be a feeling, an action, or maybe simply money. If it's a feeling or action of some sorts, it is likely you can solve it some other way. Standing Stones and Celestial Prism frequently come with better stories than duals after all. And sometimes we just might have to take a step back and realize that the object we want is out of range and move on. As a collector, I've had to do that quite a few times. A couple of them still hangs around in the back of my head. But getting upset never helped me. Magic has so much great to offer, and awesome cards and events are abundant. As players, we shouldn't let losses overshadow our gains. We should try to look for enjoyment where we can find it, and - as the nerds we are - roam freely through the mist of peers. Counter that Wanderlust with Farmstead.

Also wash your hands.

Great blag again, especially the Juzam part ;-) I can say myself that I've learned a lot from playing poker as I had to look at money in a different way. However when it comes to my collection of sealed product (FE till Alliances) the endowment effect is fully into play.

SvaraRaderaThanks Richard! Hehe, maybe I should count myself lucky that I don't have much in terms of sealed products ;)

RaderaMy Juzam are definitively worth more than yours whatever you say but i still have to convince my opponents that because of that they can swing for 6 damage . ;)

RaderaGreat write up MG! I’m actually 2/3 into thinking fast and slow. The current market is crazy but also increases the gratification off a newly acquired upgrade.

SvaraRaderaA little shoutout to the NOSMTG guys who are consistently providing the proper dosis of wanderlust, celestial prism and Yawgmoth demon action to the ODOL monthlies.

Cheers!

Oh cool! That is a fantastic book, easily one of my favorite reads in the last years. It's the kind of book that I feel that if everyone took the time read it, life would be a bit simpler ;) And I agree with the gratification part that comes with the challenge of acquiring cards. Like, getting my BB Savannah a couple of months ago was surely rough on the wallet, but now that I have it I appreciate it even more. If it would have cost a tenth I might not have felt as excited about it, as I wouldn't have had to give up other things or luxuries to the same extent to get it. Working for something makes it so much sweeter when you get it.

RaderaI'll happily join in on the shoutout to my great NOSMTG brethren ;)

Interested in your take on Black-Scholes as applied to MTG finance.

SvaraRaderaOh, that's a though one! Feels like there might be a bunch of Greeks to take into account there, and just the expected dollar/euro exchange (or, for me, NOK value) will have quite the impact. And how would one approach dividens on Mtg cards... Hm... I might pick up the gauntlet, but give me a few months with my old math books first ;)

RaderaYeah there is a lot to unpack here. Would not mind buying some teeny puts on my Alpha Lotus. I guess maybe will just grab a few extra petals...

RaderaPuts on your Lotus? Damn Mano, thought you were a lifer :P

RaderaIt is a great game and should be enjoyed in whatever way it

SvaraRaderabrings us the most joy. Completely right!

Came to see a lighthearted MtG finance article, left thinking this is more comprehensive and interesting than 99%of MtG finance. Keep it up MG! I still hope you take care of the Beta Meekstone I gave you years ago during your charity drive! Still want to sign it one day!

SvaraRaderaAnd accept me one fb one day! Haha

Thanks a lot Jonathan! And yes, that Meekstone is safe and waiting for a signature when our paths align again :)

RaderaHehe, must have missed the request on fb, I'm barely ever there these days. But if you shoot me a mess on SvM I'll be moments away ;)

Man, you're not even asking the right questions!

SvaraRaderaWho flips the coin?

What coin is flipped?

How is the coin flipped?

You tell me that, and I'll tell you if I take that flip!

I´m glad you were the one who stole my alpha lotus...

SvaraRadera; )

Haha, I'm kinda glad I did too Felipe ;) But the Beta you got certainly wasn't shabby either! When I saw your comment I had to go back and look at the post from when I got the Lotus (http://oldschool-mtg.blogspot.com/2013/11/revisting-grail.html) for a trip down memory lane. Was kinda interesting to see that we noted a few different Magic things that set you back more than an Alpha Lotus back in 2013, and now eight years two out of the three suggestions doesn't really hold water anymore. A myriad of Summer cards entered the market since, and they found an additional complete sheet of the Unl/Aq scrap prints to make a huge dent in that market as well. Iconic pre-Alpha playtest cards are still pretty damn rad though ;) But I guess Lotus will always be Lotus <3

RaderaFunny. I have spent money in tickets for music concerts without knowing wether I could assist or not because of work schedule and never regreted even I couldn't assist (happened twice). I guess the fear of missing a band I like weights more than ~50 bucks.

SvaraRadera